Tax-Efficient Withdrawals: One of the biggest reasons I believe in deep, long-term planning is because of situations exactly like this. A friend recently asked if they should sell $750k of equities to put a down payment on a house. It was a great question, but I secretly wish we had this conversation a few years ago.

Without proactive planning, you're often stuck between two less-than-ideal options. In this case:

Both are fine in a pinch, but neither is optimal. Let’s run some numbers to make this real.

Scenario A: Sell $750,000 of Stock All at Once

Let’s say you’re married, filing jointly, and you’ve got $300k in long-term gains built up over time. Here’s the rough tax math:

Total Tax Owed: ~$86,400

That’s real money. That’s a nice car. That’s 2 years of pre-school. That’s a nice kitchen renovation.

Scenario B: Plan 3-5 Years Ahead

If you know this home purchase is coming and start planning in advance, there are a few strategies that will minimize this bill:

This is why I believe deeply in customized, thoughtful planning. It’s not just about maximizing returns, it's about your entire picture.

The Bar is Low: The more time I spend operating businesses and simply being a human, the more I realize something both frustrating and exciting: The bar is low.

I don’t mean that in a cynical way. I mean it quite literally. Most people are doing the bare minimum. If you just consistently show up, put in real effort, and go above and beyond even slightly, you’re already separating yourself from 95% of the competition.

I recently hired an agency to support on a project. After a few weeks with limited positive results, I asked for a simple update. I wanted to know how things were going and how they were thinking about evolving the work. Their response? “We don’t have time to do that since we have a lot of customers.” I wasn’t asking for some giant deliverable. I was just asking for thoughtfulness. And my hunch? They weren’t actually thinking about the work at all. They were doing the bare minimum.

This happens more often than you’d expect.

At VDB Wealth, I’ve been running financial plans and deep-dive analyses for friends and early clients. It’s wild how poor the service is that many people are receiving from traditional advisors. It’s not that the advisors are malicious or unqualified. They just aren’t putting in the extra 10% of effort that makes the experience personal, clear, and useful.

On the surface, all of this frustrates me. But when I zoom out, I actually get excited. Why? Because it means there’s so much low-hanging fruit for those of us who genuinely care. For those who want to help. For those willing to do the work.

As technology continues to advance, I'm beginning to believe that thoughtfulness is an enduring competitive advantage.

So if you’re building something, managing a team, or trying to do anything in life, I have some good news.

The bar is low. Be exceptional.

Showing up on ChatGPT:

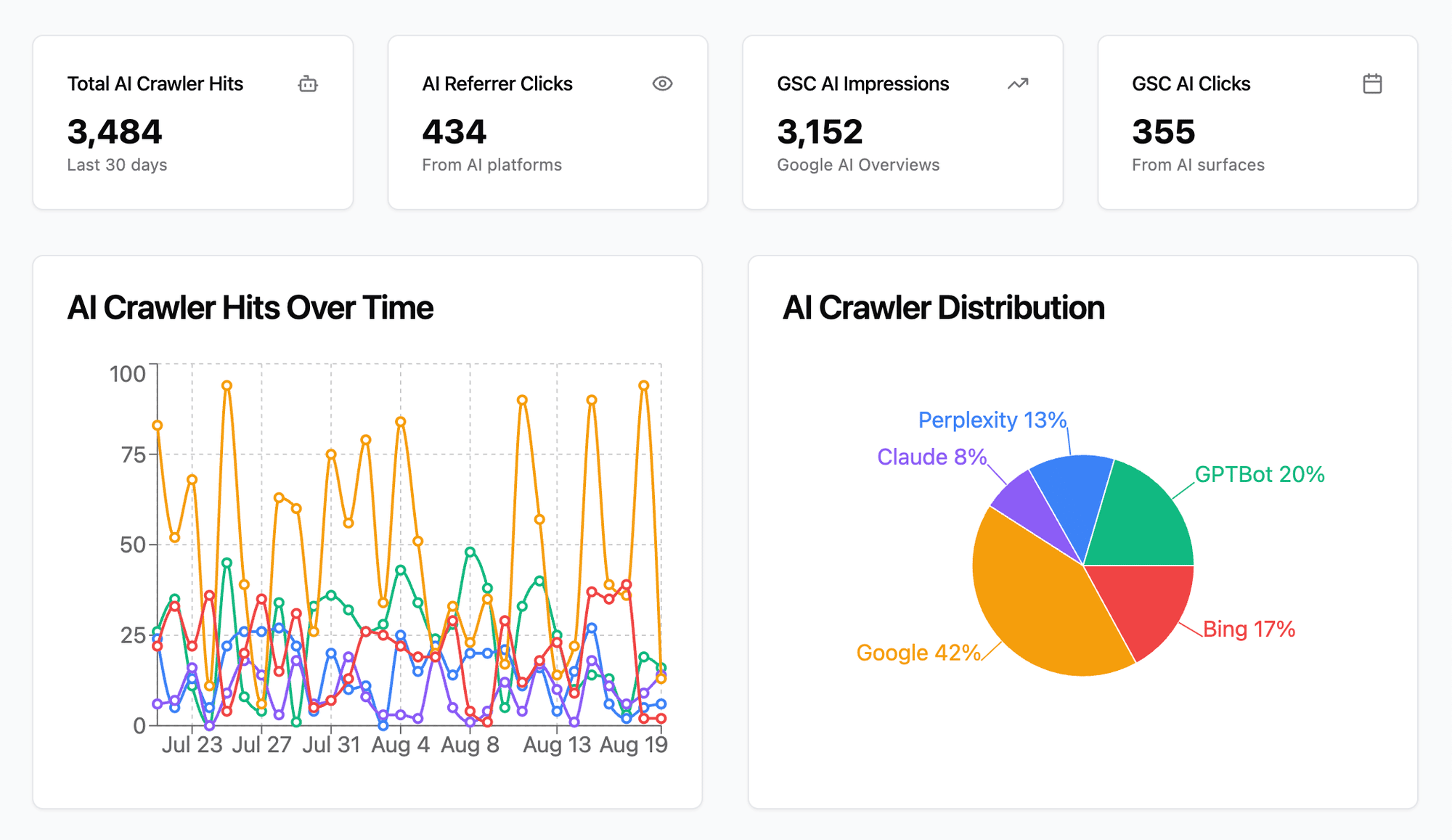

I don’t talk about this often, but I’m a co-owner of a marketing agency that does some pretty awesome web development work. Lately, we’ve been diving into how AI models interact with your website.

Our view? Traditional SEO (search engine optimization) is dying. When people use ChatGPT, Perplexity, or other AI tools to find answers, they’re often bypassing Google Search entirely. If AI doesn't understand your business, you're invisible.

Now, I’m not an AI expert. But, our team is. They've been building out AI Profiles. Think of it as a translation layer between your website and the large language models that are quickly becoming the front door to the internet.

We’re still refining the process, but it’s already showing promise. And because I love testing things out with this community, I want to offer to do a free AI audit and build a basic AI profile for anyone here who’s interested. No strings attached.

If you want one, just reply to this email and I’ll connect you with our team.

Disclaimer: VDB Wealth is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Past performance is not indicative of future performance.

We work with a select group of clients to provide tailored, high-touch wealth management. Ready to see how we can help?

Our personalized process ensures you receive expert financial guidance tailored to your unique goals. Get in touch in the way that works best for you—fill out the contact form, send us an email, or schedule a call. However you choose to reach out, we’re here to help you build, grow, and protect your wealth.